The Canada Child Benefit (CCB) has undergone significant updates for 2025, bringing increased financial support to families across Canada. This tax-free monthly payment helps parents manage the cost of raising children under the age of 18. With new payment rates and updated eligibility rules, families can now better meet their children’s needs. Let’s explore what’s changing and Continue reading

Social Security April 2025- Payment Schedule, Double Payments, SSI Updates, Eligibility, And Important Dates

Social Security benefits play a crucial role in providing financial support to millions of Americans. Understanding the payment schedule, especially with adjustments like double payments and updates to Supplemental Security Income (SSI), is essential for effective financial planning. Social Security Payment Schedule for April 2025 The Social Security Administration (SSA) disburses payments based on beneficiaries’ birth Continue reading

£3,150 Compensation For WASPI Women Confirmed- Eligibility And Payment Details Explained

Thousands of women across the UK who were born in the 1950s have reason to pay attention—£3,150 in compensation for WASPI women has now been officially confirmed as the government faces increasing pressure to address pension injustice. Here’s a full breakdown of everything you need to know, from eligibility to payment details, including the latest updates. What is the WASPI Compensation Continue reading

$500 Energy Bill Relief April 2025- Regional Eligibility & Payment Dates

In April 2025, Australian households are set to receive significant financial relief to help manage rising energy costs. The government has introduced an energy bill relief program offering up to $500 per household. This initiative aims to alleviate the financial burden on low- to middle-income families across various regions. Program Overview The Energy Bill Relief Payment Continue reading

Australia’s $1,300 Energy Rebate Is Here – See If You Qualify For This Big Bill Boost!

Struggling with high electricity costs? There’s great news for Australian households and small businesses! A $1,300 Energy Rebate is now being rolled out to help ease the burden of rising energy prices. This government initiative is part of a broader plan to provide direct financial support to those who need it most in 2025. Let’s break down Continue reading

Is the $250 Canada Training Credit Available to You? Check Your Eligibility Now!

The $250 Canada Training Credit is an opportunity for Canadians to offset the costs of training and education, ultimately helping you build valuable skills for a brighter future. Whether you’re looking to upskill in your current field, explore a new career, or change industries, this refundable tax credit can help reduce the financial burden of Continue reading

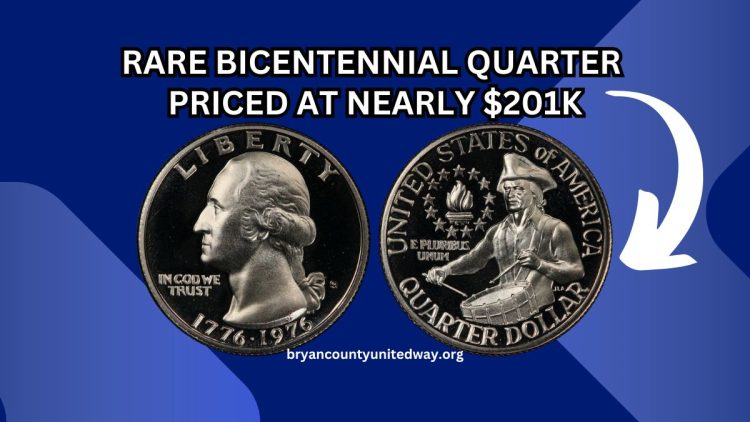

Rare Bicentennial Quarter Priced at Nearly $201K

Coin collecting is a fascinating hobby that intertwines history, art, and the excitement of discovering hidden treasures. While most quarters are worth only their face value, certain rare specimens can command astonishing prices at auctions. A prime example is the Bicentennial Quarter, which recently fetched nearly $201,000. This article delves into the unique features that Continue reading

Get $680 From The CRA In 2025! See Who Qualifies For This Surprise Payment

Many Canadians will receive up to $680 in 2025 from the Canada Revenue Agency (CRA) through the GST/HST credit program. If you’re wondering whether you qualify and how much you can get, you’re not alone. This financial support is designed to help low and modest-income Canadians cope with rising living costs. Let’s break down exactly what this payment is, who’s eligible, and how Continue reading

April 2025 Social Security Benefits- Payment Dates And Important Updates

In April 2025, millions of Americans will receive their Social Security benefits according to a structured payment schedule established by the Social Security Administration (SSA). Understanding this schedule is crucial for beneficiaries to manage their finances effectively. Supplemental Security Income (SSI) Payments SSI provides monthly benefits to individuals aged 65 or older, blind, or with qualifying Continue reading

$400 Centrelink Bonus Drops This April – Check If You’re Eligible!

As part of the Australian Government’s efforts to support vulnerable households amid rising living costs, a $400 Centrelink bonus is being distributed in April 2025 to eligible recipients. This one-off cost of living payment is designed to help Australians manage increasing expenses, including groceries, fuel, and rent. If you’re wondering whether you’re eligible and when to expect the payout, this article Continue reading